India is the world’s biggest market for renewable energy auctions, in which wind and solar project developers compete to offer the lowest possible prices for zero-carbon power. Last month, the country added a twist: a call for “round-the-clock” renewable power. The winning bid was higher than the going rates for wind and solar in previous auctions. But it was also lower than what it would cost to meet peak demand with coal-fired power in some India markets.

It’s worth unpacking the mechanics of India’s round-the-clock renewables plan, beginning with what “round-the-clock” actually means. It’s not 24-7 renewable power generation from one project; rather, it’s a requirement to provide 400 megawatts of renewable power at least 80% of the time over the course of the year, and at least 70% of the time in any given month.

Wind and solar are India’s cheapest sources of renewable power, but those 70-80% capacity factor requirements are impossible to meet with one wind or solar project on its own, for two reasons. The first is the basic diurnal nature of renewable generation—solar doesn’t generate at night, after all, and wind generation is often low midday. The second is India’s particular seasonal pattern of mid-year monsoons, which impact both wind and solar generation in different ways.

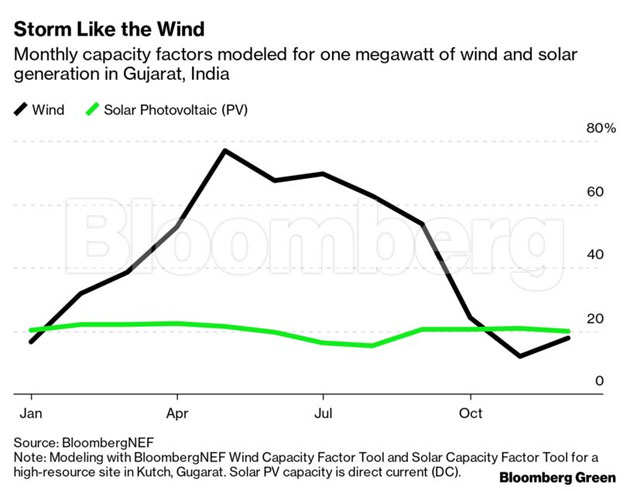

My BloombergNEF colleagues have modeled the power generation from a potential site in Gujarat, and their results show the distinct difference between wind and solar generation. Wind can produce power nearly 80% of the time in May, but less than 20% of the time in November, December, and January. Solar, while steadier, generates much less for the same capacity, and also dips during monsoon season.

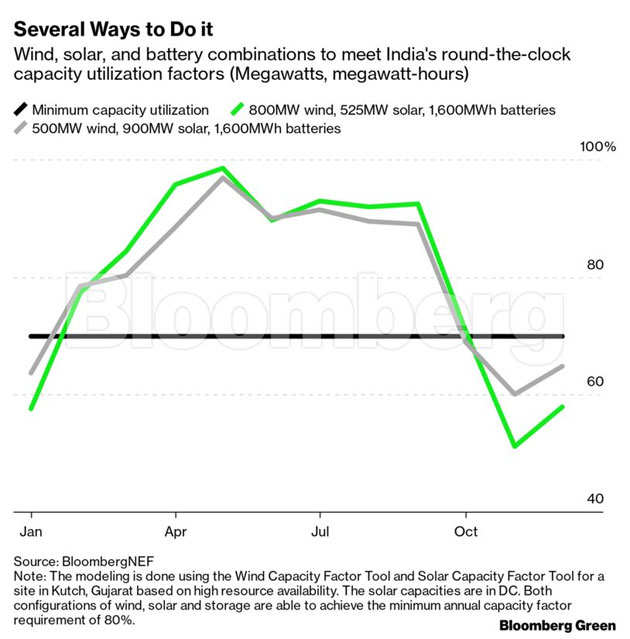

So, how to meet the government’s requirements? Two ways. First, combine resources and add batteries, which can smooth out the total capacity available from multiple technologies. Second, build more than 400 MW of wind and solar to reach that high utilization factor. How much more? Way more.

Bloomberg

My colleagues modeled two combinations of wind, solar, and batteries that would meet India’s round-the-clock requirements. One calls for 800 MW of wind and 525 MW of solar, while the other calls for 500 MW of wind and 900 MW of solar. Both require 1,600 megawatt-hours of batteries, which will come in especially handy during wind’s slow season. Both combinations achieve just over 80% capacity, but in quite different ways.

Even though India’s round-the-clock auction was a first of its kind, the same competitive dynamics that define its plain-vanilla renewables auctions apply. The final tariff awarded to the winner, Goldman Sachs-backed ReNew Power, was 19% below the opening bid. And as with every other lowest bid in previous auctions, there will be some engineering required—financial and technical—to achieve an economic return at the price.

The financial engineering strategies that my colleagues forecast include lowering the expected internal rate of return; assuming the cost of solar modules and batteries will fall in the next year; projecting lower financing costs thanks to India’s fiscal and monetary responses to the Covid-19 pandemic; and even paying penalties for under-production in some weeks, which can be recouped with power sales to third parties when output is high.

Bloomberg

On the technical side, round-the-clock renewables will likely require generating from multiple sites; using cheaper batteries that have shorter operational lives, and can therefore be replaced with a still-cheaper option in the future; potentially adding some longer-term storage options such as pumped and stored hydropower; and using advanced forecasting to better plan the cycles of charging and discharging energy storage depending on weather conditions.

If India’s power project developers can make round-the-clock renewables work on the business side, they’ll be an attractive option for India’s power buyers—and a challenge to coal-fired power generators. There are currently three groups lined up to buy power from the round-the-clock auction winner: the New Delhi Municipal Council and two western India territories, Dadra and Nagar Haveli and Daman and Diu. New Delhi’s electricity distributor is currently paying more than Rs 6,000 per MWh for its electricity supply. The Dadra and Nagar Haveli electricity distributor pays Rs 4,450 per MWh, and the Daman and Diu distributor pays Rs 3,797 per MWh. They’ll each pay Rs 3,600 per MWh for renewable power from the auction.

Not a bad deal.

Nathaniel Bullard is a BloombergNEF analyst who writes the Sparklines newsletter about the global transition to renewable energy.

0 Comments:

Post a Comment