Are documents such as residency visa, tax certificate (if any), bank statements, partnership deeds, employment contracts, and rental receipts sufficient to keep the tax officers at bay? Will the income tax (I-T) department go beyond these papers to dig deeper? Will such information be shared with the enforcement directorate? Will the Central Board of Direct Taxes clearly spell out the conditions that NRIs have to meet to avoid tax on earnings outside India during the relevant years? Or, will the rules be left to the interpretation of tax assessing officers?

ET’s queries to a CBDT spokesperson went unanswered till the time of going to press.

“More than tax, the bigger worry for NRIs is the requirement to disclose global assets once they are considered as residents. Details like overseas trusts (and beneficiaries), foundations, bank accounts, and investments in properties and unlisted entities have never been shared with the Indian tax department. In some cases, the source of money is unclear..They don’t want to be questioned on these assets and explain how these were created,” a senior lawyer in Mumbai told ET.

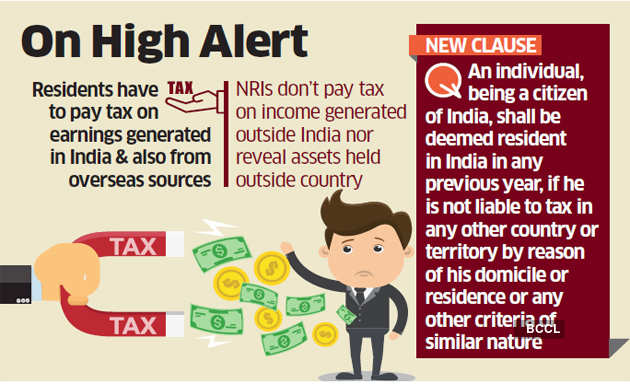

Under the Indian tax law, residents have to pay tax on earnings generated in India as well as from overseas sources; besides, they have to disclose assets held abroad. However, NRIs are neither taxed on income generated outside India nor do they have to reveal their assets held outside the country to Indian authorities. (NRIs are taxed only on income generated in India).

The budget talks about taxing “stateless people” who game the system, hop around from country to country and do not pay tax in any other jurisdiction. The government has assured that “bona fide workers” will not be taxed.

“But how do you identify those who are simply using the law to avoid tax? Genuine employees as well as those who set up partnership firm, spent enough time abroad, or become a director in some local firm to avoid tax can produce residency certificate,” said a chartered accountant.

For a tax residency certificate

For a tax residency certificate in UAE, one has to submit passport copy (with the visa proof), emirates ID, tenancy agreement, salary certificate or audited financials for dividend, last six-month bank statement, and a certificate from emigration confirming stay of more than 180 days. It costs less than 2,000 UAE dirhams (less than Rs 40,000).

The key change in residency relates to Indian citizen or person of Indian origin visiting India. They would now be resident by the Indian taxman if they spent more than 120 days in India (as against 182 days earlier). The tax implication comes to the fore with a new clause: “….an individual, being a citizen of India, shall be deemed to be resident in India in any previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.” (Here, “year” refers to assessment year and “previous year” is the financial year).

“This will hurt NRIs who have invested in India — particularly in startups or are involved in charity organisations and NGOs, and want to spend a longer time in India to supervise and handhold the ventures here.. I am sure the government is targeting fly by night operators and does not want to go after genuine people. But the law will have unintended consequences,” said a senior partner at a large law firm.

NRIs in UAE who have spent less than 180 days in that country may find it difficult to obtain residency status. Such people may show ‘substance’ — such as rental income from properties and directorship — to establish their fiscal domicile in UAE. The question is whether these strategies will convince the I-T department which is sitting on a mountain of data obtained through information sharing pacts with multiple countries. In FY21, the department may well send notices to many NRIs asking them to establish their fiscal domicile. This could trigger the tie-breaker test which arises when a person is considered resident in two countries.

But, the fear among many NRIs is that once labelled as ‘deemed resident’ they will be asked to disclose all offshore assets. Silence then would mean concealment of information — an offence punishable under recently enacted harsh tax-avoidance laws.

0 Comments:

Post a Comment