In 2010, Qatar had successfully bid to host the 2022 FIFA World Cup. The Qatari government ingeniously decided to house visitors on dhows anchored on the emirate’s waterfront. Dhows are wooden ships with triangular sails, made by traditional carpenters in Beypore.

“Qatar had plans to order some 100 wooden long boats. Some of the orders had come to us also… But these started getting cancelled after crude prices fell and Qatar-Saudi Arabia relations soured,” rues Abdulla Baramy of Baramy Ship Builders.

Since its founding in 1954, Beypore-based Baramy Ship Builders has built close to 110 dhows for buyers in the UAE, Kuwait, Oman and Qatar. But their order book has shrunk over the past few years — almost in line with the dipping fortunes of their buyers. “We make small boats for local fishermen these days. We also do odd repair jobs,” shrugs Baramy.

The economic slump, arising out of an unprecedented fall in crude oil prices and simmering geopolitical tension in the Persian Gulf, are sending shock waves across the Arabian Sea. The fair winds that ferried labour and material between Arabia and India have slowed down considerably.

Consequentially, NRI remittances to India from the GCC or the Gulf Cooperation Council countries — comprising Bahrain, Kuwait, UAE, Oman, Qatar & Saudi Arabia — have slid alarmingly.

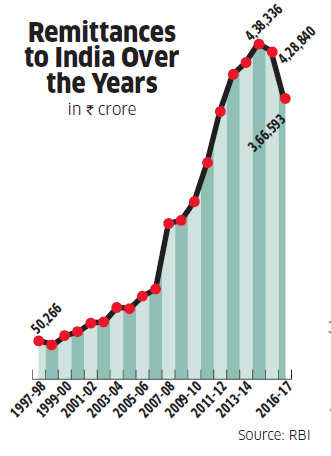

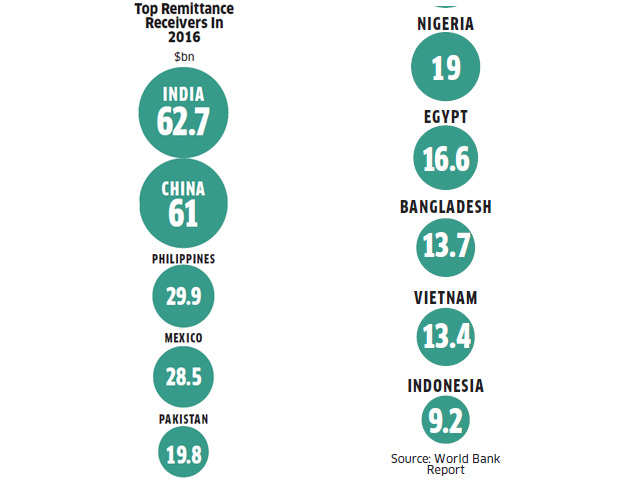

India, the largest remittance-receiving country worldwide, witnessed a near 9% drop in NRI pay-in flows to $62.7 billion in 2016 over the previous year, as stated in a World Bank report. Much of this shortfall has been attributed to the economic downturn in GCC states. As per RBI scrolls, inward remittances have fallen from a peak of Rs 4.38 lakh crore (in 2014-15) to Rs 3.66 lakh crore last fiscal, a 12% decline.

“It is a case of an overall economic slowdown in the Gulf; lower oil prices have resulted in an economic slowdown in that region,” says Madan Sabnavis, chief economist at CARE Ratings. “The slowdown in that region has also resulted in paycuts and job losses. The IT slump may have impacted remittances from North America too.”

Send Money Home

How important are remittances for India? Not much, if you are only considering the proportion of remittances to the GDP. Inward remittances account for just 3% of India’s GDP. But, at a sub-national level, remittances play an important role. Take Kerala, which receives the lion’s share of its remittances from the Gulf region. Remittances account for over 36% of Kerala’s state domestic product and contribute significantly to household consumption.

That apart, remittances become critical in times of high trade deficit, which is not a worry at this point in time, reckon economists. Trade deficit is when the cost of country’s imports exceeds the value of its exports.

“Remittances provide a cushion in times of higher trade deficit. The impact of lower remittances would have been higher had global commodity and raw material prices been higher,” says Devendra Pant, chief economist at India Ratings. “If there’s a slowdown in India, our current account deficit may creep up. Without adequate remittances, the rupee could come under pressure as well.”

Beyond that, states with high migration rates (Kerala, Tamil Nadu, Punjab and Karnataka) have workforce from low migration states taking up unskilled or semi-skilled jobs. States like Kerala, Tamil Nadu, Karnataka and Punjab have migrant labourers from Uttar Pradesh, Bihar, West Bengal and Odisha earning their livelihood. If Indians in GCC cut the value of their money orders, there would not be enough jobs for inland migrants (see Say Hello to Replacement Migration).

“If the Gulf starts sending back our citizens, we will be in trouble. Unemployment rates will go up. People from states with low migration rates, who go for employment to states like Kerala, could be hurt financially,” Pant warns.

The Dependency Factor

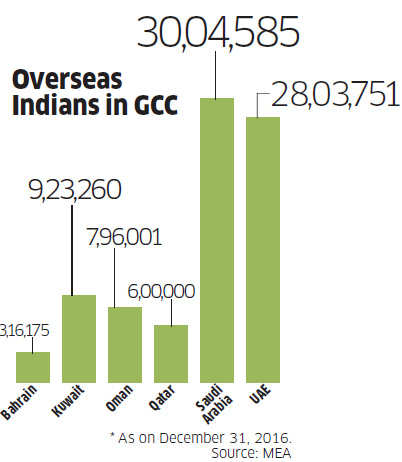

As per External Affairs Ministry data, nearly 85 lakh Indians work or reside in GCC countries. In the first seven months of this year, over 2.77 lakh Indians relocated to the Gulf in search of jobs. The UAE has absorbed most of these jobseekers (about 1.10 lakh Indians), followed by Saudi Arabia (59,911), Oman (42,095), Kuwait (40,010) and Bahrain (7,591).

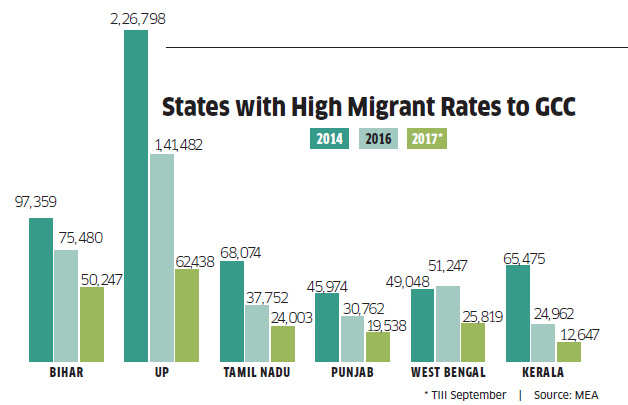

Uttar Pradesh, with over 62,438 persons, tops the Gulf migrants list, followed by Bihar (50,247), West Bengal (25,819) and Tamil Nadu (24,003). Number of Gulf migrants from Kerala has reduced considerably over the past few years.

“The demographic profile of people going to the Gulf is changing,” says S Irudaya Rajan, professor at the Centre for Development Studies (CDS), Thiruvananthapuram. Rajan has spearheaded several research studies on labour migration. “Not many people from Kerala or Tamil Nadu are going to the Gulf anymore. Till some time ago, they were being replaced by people from UP, Bihar and West Bengal.

Now, they are being replaced by non-Indians — mostly people from Vietnam, Philippines, Bangladesh, Nepal and Sri Lanka.” GCC (along with North America and Europe) made India one of the largest receivers of remittances in the world. In 2015 alone, India received $34.67 billion from the UAE, Saudi Arabia, Kuwait, Qatar and Oman. Data for Bahrain is not in the public domain. Close to 35% of net remittances to India flow in from the GCC.

Bulk of migrants going to GCC from India are semiskilled or skilled labourers. About 30% of Indian expatriate workforce is white-collar professionals, populating the services and IT sectors.

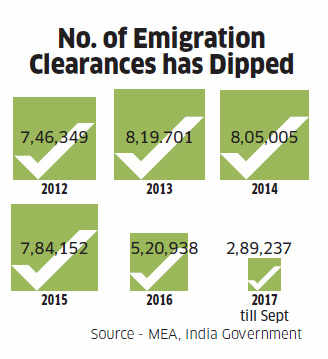

Over the past few years, the Centre has set “preconditions” for Indians desiring to migrate for work. These are in the form of minimum referral wages and age bars for certain types of jobs. For instance, the government does not recommend women below 30 years to become housemaids in GCC. These conditions, albeit for the good of the people, have reduced the “employability” of Indians in GCC. Inevitably, Gulf employers have begun to prefer people from other South Asian countries to Indians. By and large, emigration statistics reflect a steady decline in passage to Gulf, reveal MEA data (see States with High Migrant Rates to GCC).

“The long-term outlook for Indian migrants is bad. Many will have to come back home in a few years,” says Arthur James, senior manager at India-GCC SME Business Council, an SME chamber. “People above 50 years of age are vulnerable as they are being replaced by younger people, who are willing to work for even Rs 15,000 a month,” James adds.

The drop in crude prices has dealt a severe body blow to the once-thriving GCC economy. The price of crude dropped from $110 per barrel levels in 2012 to $22 (per barrel) in early 2016, and is currently hovering at $56 per barrel. The oil slump has impacted Saudi Arabia and Qatar the most.

“The lower price of oil means less money to go around, and GCC economies are largely oil-dependent. Remittances are unlikely to recover unless oil price again recovers to $100 per barrel level, which seems unlikely in the next couple of years,” says Amit Bhandari, fellow, energy and environment studies, Gateway House, a think tank.

The Saudi-Qatar conflict is adding to the gloom in the region. With the UAE, Bahrain, Libya, Yemen and Egypt joining forces with Saudi Arabia, this fight has become more of a geopolitical tussle.

The tension between Qatar and its neighbours has increased as the former, thanks to its mammoth earnings from production and export of gas, vies for regional leadership. Security and stability in the GCC is of paramount importance to India as nearly a crore of its citizen work (and remit money back home) in the region. India relies on some of these countries for its energy/petroleum needs as well. In case of a protracted stand-off, India may be forced to intervene diplomatically as its stakes in GCC are high.

“Even a small socioeconomic change in the region can have a considerable effect on remittances to India,” says Sohini Rajola, regional vice-president (India and South Asia), Western Union, a money transfer service provider. Policies for nationalising the workforce in GCC countries and anti-immigration sentiments are discouraging employers from hiring foreigners. Saudi Arabia, which has the maximum number of Indians in GCC, has long implemented Nitaqat, a policy that ensures jobs for Saudi nationals.

The implementation of Nitaqat has impacted Indians. Unofficial estimates reveal that over a lakh Indians have lost jobs in Saudi Arabia. “West Asian countries have a young population, with a large number of people entering the workforce. Governments need to find work for these young people — or they risk unrest,” reasons Bhandari of Gateway House.

Several emirates in the Gulf are now contemplating taxation on outward remittances, in their bid to raise revenue, and in part, to discourage migrants. The list of countries where such taxes are being considered includes Bahrain, Kuwait, Oman, Saudi Arabia and the UAE, says a World Bank report. Some Gulf countries are also trying to start indirect taxation on goods purchased by citizens and residents. Starting January, both Saudi Arabia and UAE would impose 5% VAT on goods and services. Such measures would take away the charm of “tax-free” earnings for most migrants.

Less Savings

Remittances are related to savings. Over the last two years, with a slowdown of GCC economies, there has been a visible impact on earnings and savings of migrants. For instance, variable income such as sales commission, incentives and bonuses have dropped across businesses. Job losses and reduced hiring are also responsible for the drop in remittances.

“The near- to mid-term outlook for the GCC is generally neutral. The only country that can see a turnaround from the status quo is the UAE, where there is a concerted effort to propel economic growth,” says Krishnan Ramachandran, CEO of Barjeel Geojit, a UAE-based stockbroking firm.

Cost conservation was an immediate step taken by companies (and governments of GCC) after crude started its consistent slide. This squeeze in spending has had a cascading effect across sectors, and job losses followed.

BFSI, real estate, trading and IT were the worst affected. “The GCC job market may take one to three years to return to normality. Hiring will continue, albeit at a slow pace and will be more need-based,” Ramachandran adds.

In its heyday, Arabia made billions of dollars, selling oil to countries far and wide. But they do not rake in the greenback like they did — a truth India will have to reconcile with.

Say Hello to Replacement Migration

States like Tamil Nadu and Kerala have seen a significant rise in migrant labourer population over the past one year. Economists and academics term this trend “replacement migration”. People from states such as Odisha, West Bengal, Uttar Pradesh and Bihar relocate to states with high-migration rates in search of jobs. They move to Tamil Nadu, Kerala, Haryana and Punjab, among others, to take up jobs left vacant by the residents of those states who have migrated to other countries — especially the Gulf.

“Close to 40 lakh Keralites work outside Kerala. Migrants from other states help to replace them. They are doing ‘3-D jobs’: jobs that are dirty, dangerous and demeaning — just what Keralites do in Gulf,” says S Irudaya Rajan, professor at the Centre for Development Studies (CDS), Thiruvananthapuram. Kerala is home to nearly 25 lakh migrant workers, with over 2 lakh people coming in every year. Most migrants from Kerala go to the Gulf countries. Neighbouring Tamil Nadu also faces a similar problem, but its migration profile is evenly distributed within the country, and all across the world. A slump in GCC may not impact Tamil Nadu as much as it will harm Kerala, economists believe.

“There’s no large-scale return of migrants (from GCC) as yet. Migrants may be staring at paycuts, but they are not still out of jobs,” says Madan Sabnavis of CARE Ratings. “Fears of large-scale repatriation and its indirect impact on replacement migration are a bit far-fetched at this point in time,” he adds.

0 Comments:

Post a Comment