The COVID-19 pandemic has delivered a sudden and severe shock to the global economy. Widespread fear of infection as well as harsh social distancing measures put in place by governments world over (such as the five successive lockdowns in India) have brought all, but the most essential economic activity to a grinding halt. While the virus has claimed about 370,000 lives globally and about 5,000 lives in India, according to CMIE data it has already put 122 million Indians out of work. According to CRISIL, Fitch, SBI Research, it widely expected to tip India into a full-blown recession – its first in 40 years, with Arthur D Little saying it will push 120 million people back into poverty and destroy opportunities of upto $1 trillion in GDP.

The banking and financial services sector will be hit very hard

The banking and financial services industry, which forms the bedrock of every major country’s economy has not been insulated from all of this mayhem. The Reserve Bank of India says, banks have roughly 1.92 trillion dollars of credit outstanding and hold deposits worth about 1.69 trillion dollars. Banks, NBFCs, HFCs and other financial institutions have been hit very hard by COVID-19 and it is about the get very ugly very soon. The following are two major problems the sector will face.

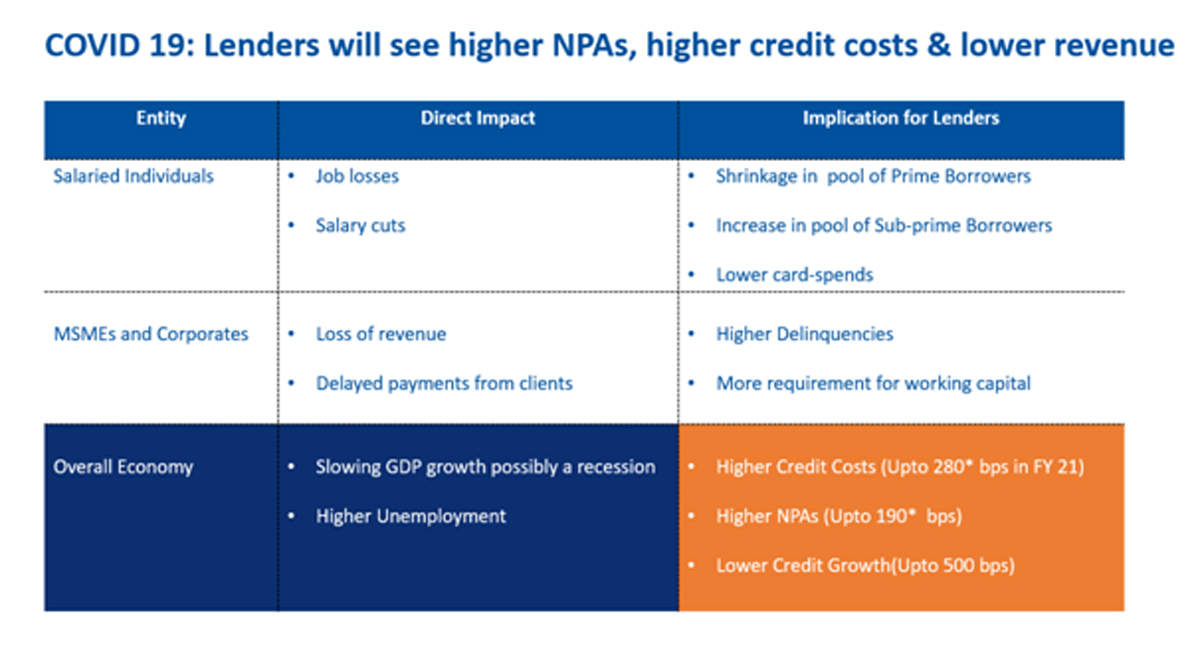

Problem 1: Skyrocketing bad loans, spiralling credit costs & falling credit growth

Bad loans (NPAs) are set to skyrocket, credit costs likely to zoom and portfolio quality set to crumble in the post COVID world. As companies lay off employees and cut salaries, existing borrowers with retail loans e.g. personal loans, home loans etc. will find it harder to make their EMI payments. This results in deterioration of the credit quality of existing retail portfolios. Further, the pool of potential borrowers (of good credit quality) shrinks, making future disbursements of new loans riskier.

The logic is similar for MSMEs and Corporates- the long lockdowns and an overall risk aversion hurts the revenue and profitability of MSMEs and corporates, thus making it harder for them to pay their existing loans off in a timely manner. As a corollary, the overall lendable-pool of creditworthy MSME and Corporate borrowers shrinks making it harder for banks & NBFCs to find good borrowers to lend to.

S&P estimates that credit costs would increase by 280 bps and system-wide NPAs by 190 bps in FY 21 due to the COVID-19 related global economic recession. Bankers fear that loan disbursals could fall by anywhere between 500 and 800 bps. This is what catastrophe in the banking world looks like.

The large banks with the lowest cost of capital (thanks to a fantastic deposit franchise) can afford to stick to employees of Category A companies, lend only to investment grade corporates operating in sectors not heavily impacted by the impending recession, but what will the scores of other banks and hundreds of NBFCs, HFCs and other lenders do? Not lending at all is not an option, but finding good borrowers is not easy – thanks to the post COVID economic environment.

The solution: Combine fundamental Factor models with Machine learning models

Step 1: Re-asses the true risk of your existing loan portfolio in the new post-COVID economic environment

COVID-19 and the impending recession have completely changed the risk levels of all loan portfolios. A big problem today is that credit managers and risk managers have a very hazy idea of the true risk levels of their existing loan portfolios thanks to:

- The absence of repayment data from borrowers who have been granted moratoriums

- The absence of repayment data on off-book loans normally reflected in credit bureau scrubs

Further, the nature of risk today is determined, no longer largely just by credit history (as it was before COVID), but also by a variety of factors pertaining to the financials of the borrower and the nature of the industry in which he/she works (also true for SMEs). Therefore, existing risk scorecards need to be re-worked and existing models updated immediately.

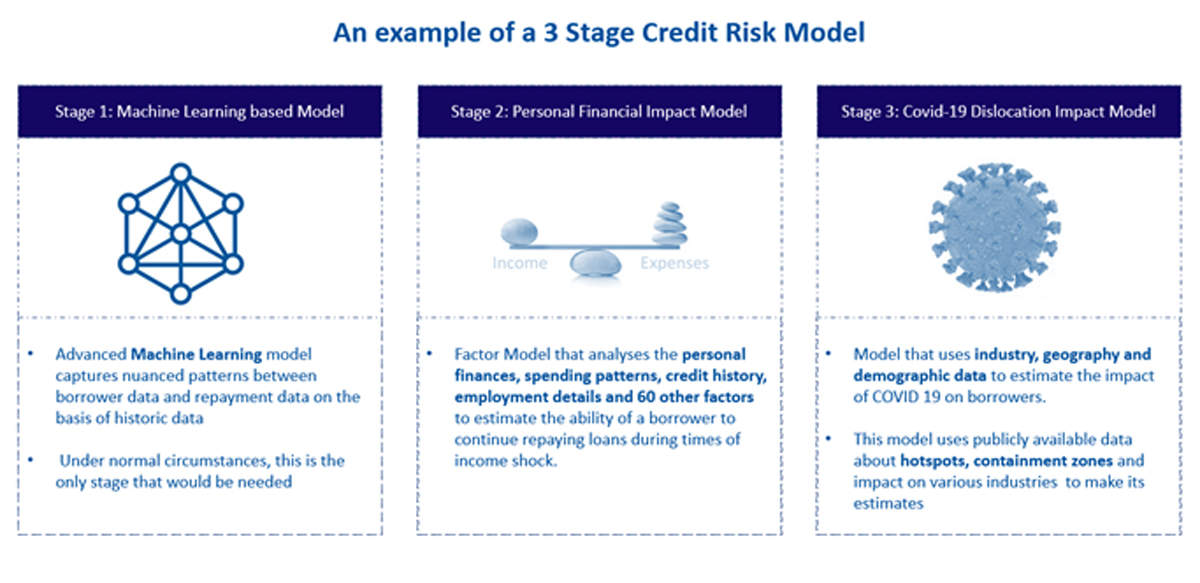

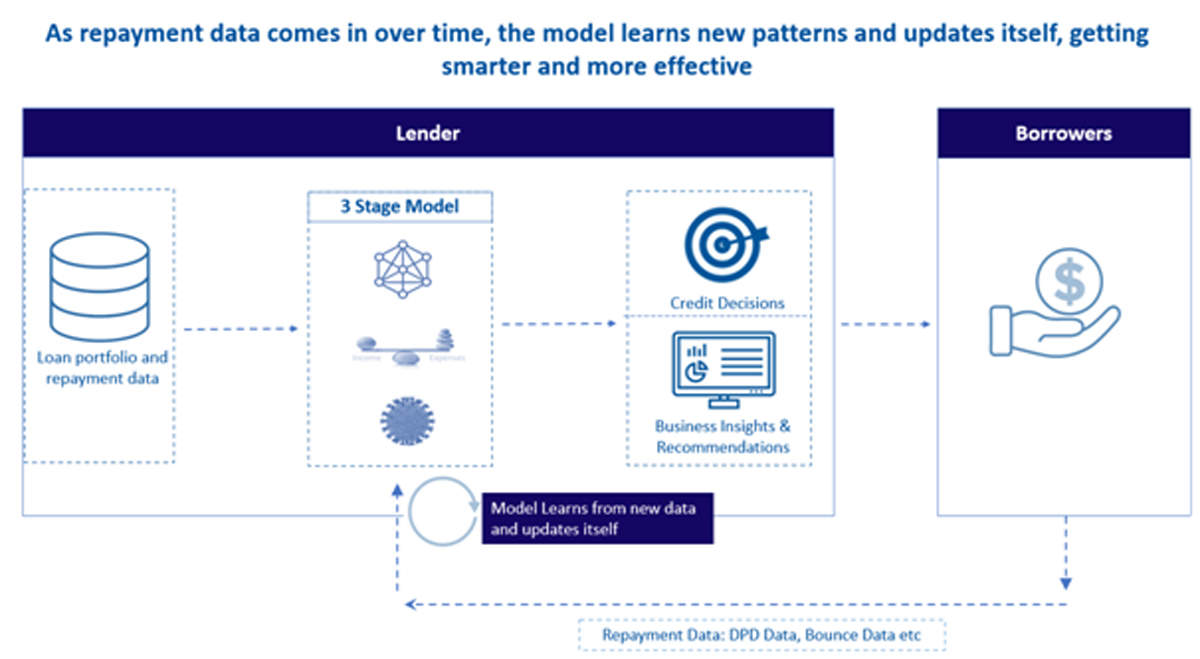

Machine learning models do a great job of identifying patterns that separate risky loans from safe loans, but given the change in economic environment, they need to be augmented by fundamental factor models that assess the financial resilience, nature of the operating environment and the actual COVID impact on every borrower, be it an individual or a business. The architecture of such model is elucidated below:

As time passes and the moratorium ends, repayment data will come in and the need for Stage 2 and Stage 3 would diminish rapidly as the core machine learning based models would be able to learn the new patterns that separate risky loans from safe ones in the new environment.

Step 2: Actively engage with your risky customers, cross-sell more to the credit-worthy customers

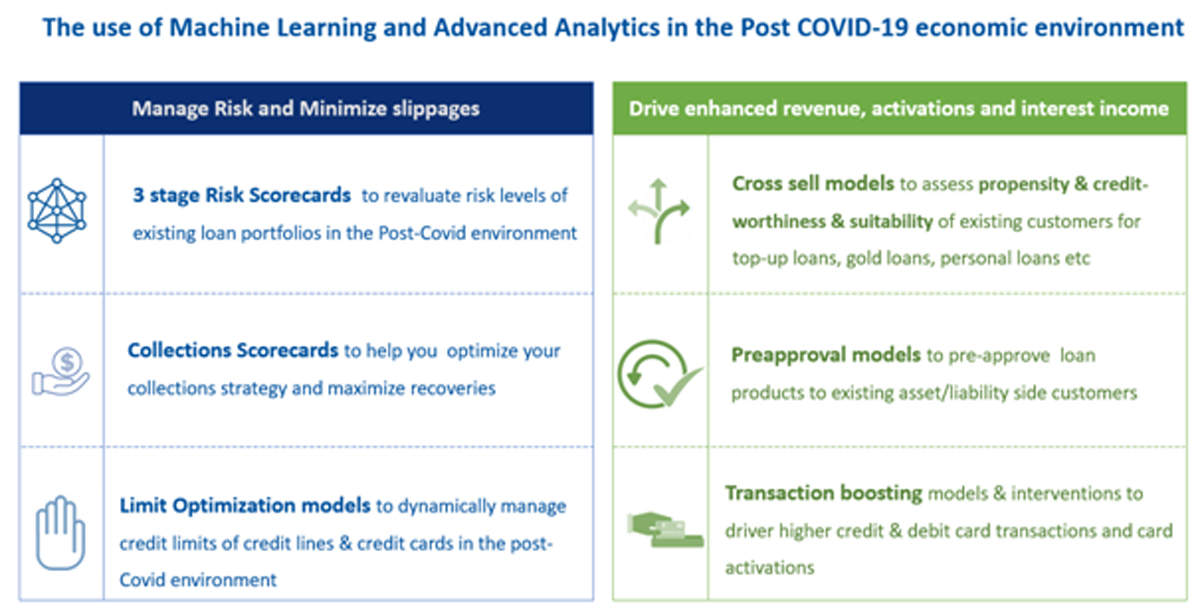

Once you have a good model that can quantify the new credit risk associated with each loan in the new economic environment, you can easily identify which loans are risky and which ones are creditworthy.

A good collections model (usually a machine learning model) can form the basis of your strategy to mitigate the risk associated with your risky borrowers while a good cross-sell model can be used in conjunction with the 3 stage credit model we discussed earlier, to sell new credit e.g. top-up loans, enhancements of credit limits (to LoC customers), gold loans, to the creditworthy borrowers identified by the model. It will come as no surprise to most lenders that even creditworthy borrowers seek credit during these difficult times.

This strategy simultaneously protects your existing portfolio while helping you grow your loan book in a safe and a data-driven manner.

Problem 2: Branch banking activities take a hit

Branch operations have been severely impacted over the last few months (due to the lockdowns and the fear of infection), limiting the ability of banks and financial institutions to lend, take deposits and conduct other routine business. The lockdown will be lifted eventually, but the fear of infection will linger on till a vaccine becomes, not just efficacious but also widely available- something that most experts say will take a minimum of 18-24 months. As the risk of infection lingers and friction levels associated with banking at branches persist stubbornly, banks and lenders are likely to see a significant deterioration in loan disbursals, revenue from the sale of financial products and in some cases, even deposits. In the present environment, branches simply won’t be able to efficiently handle the kind of load that a growing lender would generate with all of the social distancing measures in place and the omnipresent risk of a sudden lockdown, much like the Sword of Damocles.

The solution: Embrace technology

Most large banks have mobile banking applications and net banking portals, but for these to take over the heavy lifting from physical branches, they need to be much more user-friendly, scalable and have more functionality. Customer behaviour will change automatically because customers will find it much safer, easier and more convenient to transact via online and mobile channels than branches with tough social distancing measures.

On the lending side, the process is largely manual even in 2020, with some technology used for specific tasks. This has to change and lenders have to go paperless and completely digital. This would include e-KYC, Video-interviews for Personal Discussions, paperless processing, warehousing of ALL data collected during the application process (even data that is normally deemed useless) and Straight Through Processing of loan applications with minimal or no human intervention (below a certain ticket size) and digital disbursement. All of this will cut costs, cut turn-around-time and boost efficiency like no other initiative probably will.

We have started to see some very good banking apps that allow customers to perform most transactions without having to go to a branch. E.g. SBI’ s Yono Lite (1.8 million downloads and 4.5 on Play Store) and ICICI Bank’s iMobile (2 million downloads and 4.4 on Play Store). A lot has been done, but a lot more remains.

On the lending side, the gap is much wider with extensive use of field visits, in-person interviews and home-visits. All of this cannot go on as usual in the post Covid environment when the risk of infection would mean that field visits and in-person interviews become less viable. However, there is innovation in this space too. For example, Kotak Mahindra Bank and Bajaj Finserv offer paperless loans to a prime segment of salaried customers. Paperless loan processing is not exclusive to large banks or NBFCs. Multiples backed lender- Vastu Housing Finance too has equipped its field force with tabs with their award-winning Pulse App installed. This lets its executives capture all information electronically while doing away with paper entirely.

I am not advocating paper-less workflows because of a love for the environment, but simply because it is the most efficient way to do business. Information that is captured by one application in a digital manner is easy to make available to upstream and downstream applications, giving the lenders’ analytics teams invaluable data about customers – data that can be used to build powerful machine learning models that can significantly add value to everything from loan sourcing, credit underwriting, cross-selling and collections. It is not for nothing that data is said to be the new oil.

Putting it all together

The common thread holding together the solutions proposed (to possibly two of the biggest of the sector) consists of 2 Ts i.e. Technology and (Digital) Transformation. However, we have left out another important T – Time.

Banks and lenders should aggressively adopt new technologies while undergoing digital transformation to enable them to operate more efficiently, cut costs, and drive profitably in the post COVID environment. However, it is only the third ‘T – time that will truly bring back the profit margins and growth levels of the past.

Given time, the lockdowns will open up, economic activity will resume, a vaccine is bound to be found and widely available. Loan portfolios will heal as borrowers slowly regain their ability to service EMIs. Customers will become creditworthy again as they take up new jobs created by the economic recovery or start MSMEs during the recovery. The only thing that would have drastically changed by the is the very nature of the banking and lending industry- it would have, by then, become far leaner, far more efficient and completely ready to form the bedrock of one of the fastest growing economies of the world again.

(The writer is the Founder of Monsoon CreditTech, a fintech company whose machine learning platform is used by some of the largest banks and financial institutions across 3 international geographies.)

0 Comments:

Post a Comment