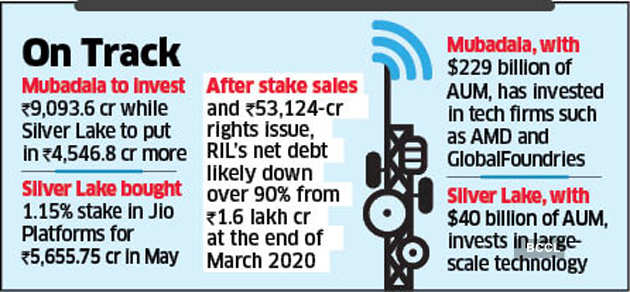

The investment of Rs 9,093.6 crore from Mubadala is a fresh one and was announced early on Friday, and helped push the shares of RIL to an all-time high. The investment by Silver Lake was announced later in the day, and came exactly a month after it had bought a 1.15% stake early May for Rs 5,655.75 crore. The latest round takes the investment by Silver Lake and its coinvestors to Rs 10,202.55 crore for a 2.08% stake.

These investments peg Jio Platforms’ equity value at Rs 4.91 lakh crore and enterprise value at Rs 5.16 lakh crore. It stands to garner Rs 92,202.15 crore from six investors in exchange for an 19.9% stake.

The funds coming from stake sales in Jio Platforms and the Rs 53,124 crore from a rights issue will help lower Reliance’s consolidated net debt by over 90% from Rs 1.61 lakh crore at the end of FY20.

On Track to have Zero Net Debt

Reliance is now well placed to meet its zero net-debt target by March 2021, analysts said.

“Through my longstanding ties with Abu Dhabi, I have personally seen the impact of Mubadala’s work in diversifying and globally connecting the UAE’s knowledge-based economy,” Mukesh Ambani, chairman of Reliance, said in a statement issued early Friday. “We look forward to benefitting from Mubadala’s experience and insights from supporting growth journeys across the world.”

“…I would like to emphasise that Silver Lake’s additional investment in Jio Platforms, within a span of five weeks during the Covid-19 pandemic, is a strong endorsement of the intrinsic resilience of the Indian economy, which will surely grow bigger with comprehensive digital enablement,” Ambani said in a separate statement later in the day.

Mubadala, with $229 billion of assets under management, has invested in technology firms including AMD and GlobalFoundries. It opened an office in San Francisco in 2017 and invested in Silicon Valley entities in partnership with SoftBank as Abu Dhabi pitches itself as a hub for innovation, which is central to the Emirate’s economic diversification strategy.

“We have seen how Jio has already transformed communications and connectivity in India, and as an investor and partner, we are committed to supporting India’s digital growth journey,” said Khaldoon Al Mubarak, managing director at Mubadala. “With Jio’s network of investors and partners, we believe that the platform company will further the development of the digital economy.”

Reliance shares touched an all-time high of Rs 1,617.70 on the BSE Friday, before closing at almost the same price. The Sensex gained 0.9%.

Analysts said Reliance may now be close to the end of this flurry of deals, having crossed its fund-raising target. Shortly after Facebook announced to buy a 9.99% stake in Jio platforms for Rs 43,574 crore, Reliance said it had reached agreements with regard to half the quantum of funds it was aiming to raise by way of stake sale in Jio Platforms.

Besides Mubadala, Abu Dhabi Investment Authority, Abu Dhabi’s largest state investment arm, and Saudi Arabia’s sovereign wealth fund Public Investment Fund, were also in talks to invest in Jio Platforms, ET had reported earlier.

The Jio Platforms unit comprises mostly its telecom business under Reliance Jio Infocomm, which is the largest in the country with more than 388 million subscribers, besides other digital properties and investments. Reliance, which is trying to transform into a consumer technology giant from an oil and petrochemicals major, has talked about building Jio Platforms into a digital entity on the lines of Alphabet and Tencent.

Before Mubadala, Jio Platforms had so far attracted investments from Facebook and private equity funds Vista Equity Partners, General Atlantic and KKR, besides a first tranche from Silver Lake.

“…We are excited to increase our exposure and bring more of our coinvestors into this opportunity…The investment momentum behind Jio validates a compelling business model and underscores our admiration for Mukesh Ambani, his team and their courageous vision in creating and building one of the world’s most remarkable technology companies,” said Egon Durban, Silver Lake Co-CEO, in a statement.

The fund-raising, ahead of an expected IPO in two years, comes as Reliance raised Rs 53,124 crore from a rights issue that closed on Wednesday.

Morgan Stanley was the financial advisor to Reliance while AZB & Partners and Davis Polk & Wardwell acted as the legal counsel for the Mubadala deal.

For the Silver Lake deal, Morgan Stanley acted as financial advisor to Reliance Industries while AZB & Partners and Davis Polk & Wardwell acted as legal counsels. Latham & Watkins LLP, Shardul Amarchand Mangaldas & Co and Simpson Thacher & Bartlett LLP acted as legal counsels to Silver Lake.

Reliance is in talks with Saudi Aramco for the sale of a fifth of its oil-to-chemicals business in a $15 billion deal. It has sold half of its fuel retail venture to BP Plc for Rs 7,000 crore and its telecommunication tower business to Brookfield for Rs 25,200 crore.

The sharp drop in global oil prices this year and demand compression in most global economies could make an Aramco deal difficult, some analysts said. The Brookfield transaction is yet to receive government clearance.

0 Comments:

Post a Comment